As a London based financial technology (fintech) company, Trading 212 has been the UK’s number 1 trading and investing app since 2016. With the mobile app having been downloaded over 15 million times and rated by over 180,000 customers, Trading 212 allows beginners and experts alike to trade stocks and shares with zero commission fees.

Shares and Investments have long been a thing that many people stay away from when it comes to making money online however the trading tools available on the Trading 212 platform allows users to invest in shares, but also offers exchange-traded funds (ETFs), contracts for difference (CFDs), as well as gold, cryptocurrencies, and an ISA.

With other platform trading options out there, let’s have a look and review what Trading 212 has to offer that sets it apart from the crowd and if it is worth opening a 212 account.

What does Trading 212 have to offer?

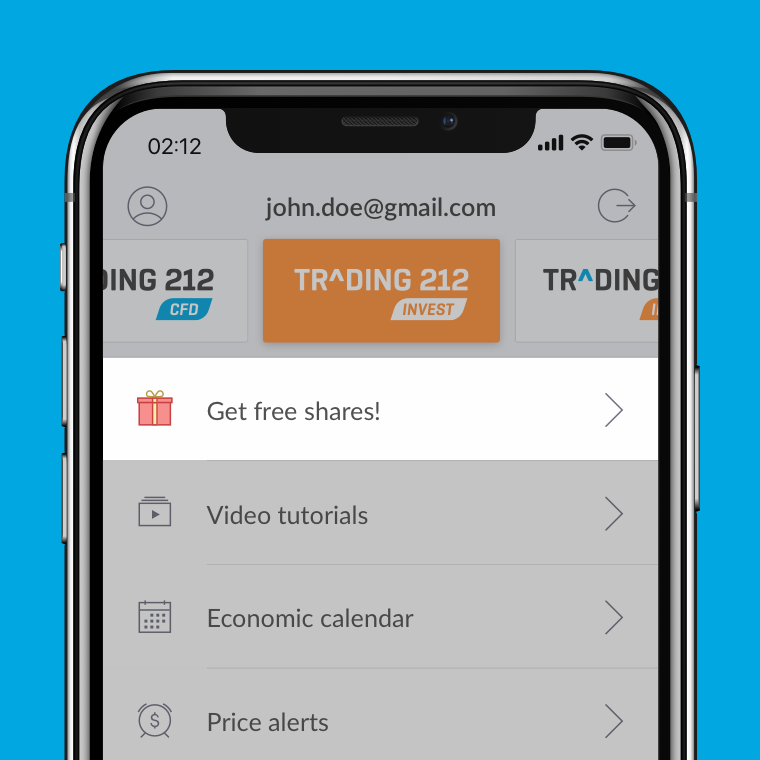

Simply by using their mobile app or website, Trading 212 allows you to invest money into a variety of markets. They offer 3 types of account: CFDs, investing, and the option of an ISA. The trading app allows users to switch between the different account types.

As well as the 3 main accounts that are offered by Trading 212, there is also the option to use a demo account for free. This option allows you to practice investing in shares and to trade CFDs risk-free, using a virtual £50,000. With no need to use any of your own money, this is a great opportunity to learn about the platform and how it works.

What Trading 212 offers that some fintech companies lack is security. The company is authorised and regulated by the Financial Conduct Authority (FCA). What this means to users is that their funds are held in separate accounts and covered by the Financial Services Compensation Scheme (FSCS) and, in the event of any default, up to £85,000 is available in compensation.

Before taking a look at what else Trading 212 has to offer that sets it apart, let’s review the 3 account types on offer and how easy they have made it to invest in the financial markets with the free trading app.

Invest

With the invest trading option from 212, you have the opportunity to invest in over 10,000 shares and ETFs. To get started, you can invest as little as £1 (increasing to £10 if you set up funding via bank transfer) and receive a share in some of the world’s biggest companies. This is made possible by the 212 invest account offering fractional shares.

A fractional share means that instead of owning a full share of a stock, you own a portion of one. What does this mean to you when you are looking to invest? It means that with just a small amount of money you are able to invest in some of the biggest companies out there: shares in the likes of Google, Tesla, Amazon, and Apple are within anyone’s reach through Trading 212’s invest option.

The 212 invest option allows you to purchase shares in companies that are listed in the UK, Germany, Madrid, Netherlands, Switzerland, and the US. Where Trading 212 really comes to the fore though is when you consider each trade has zero commission. With other companies charging up to £13 per trade, the 212 trading app can leave you with significant savings and more money in your pocket.

A useful tool offered on the trading platform is 212’s Autoinvest. As the name would suggest, this trading tool allows you to invest in shares automatically. You set your money to work for you by building a portfolio of stocks and ETFs that form slices of a pie. By creating a plan, and with reviews of your goals, you can deposit funds as well as invest and reinvest dividends automatically into your pie. If you have extra funds available, you can increase the slices of your pie. Likewise, if you need to withdraw your funds, you are able to do this too.

Trading 212 ISA

With a minimum investment of £1, these ISAs offer what any other ISA in the UK does: the opportunity to earn tax-free. Investing in a Trading 212 brings all of the benefits that a 212 invest account brings, but with the added advantage that we have already mentioned.

For UK-residents, this means that up to £20,000 can be invested each year with any returns not being subjected to tax. The advantage of a Trading 212 ISA above any others on offer is that it is free from fees. Whereas other providers charge:

- Administration fees

- Commission on each trade

- Fees for dividend reinvestment,

Trading 212’s ISA is 100% fee-free. The lack of fees, and tax-free returns, effectively allows users free trading across all stocks and ETFs that are available in the Trading 212 Invest account.

Users are able to trade in US Dollars, Euros, and pounds, and Trading 212 will execute all withdrawal requests within 2 business days via their app or website.

CFD

Trading 212 themselves state that you can “Trade stocks, forex, indices, and more,” with “Zero commission,”. You are able to trade all major markets including commodities such as gold, silver, and oil.

With, or without, experience, CFDs can be risky. You are investing in the hope that an asset’s price will rise or fall as you have predicted. Whilst there are tools that will allow you to make an educated decision, rather than a guess, there is no fool-proof system here. Trading 212 issues their own warning:

“CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.”

Some reviews will suggest that CFDs are simply a form of gambling and you are risking money blindly hoping that the value of an asset will go up or down. While there is risk involved, experienced users will use technical analysis to try and anticipate price movement. The area of technical analysis is a complex one and certainly not somewhere for novices to dabble. The theory behind this is that markets move in a pattern that can be predicted. Investors that use technical analysis read chart patterns to establish historic price activities that are likely to repeat themselves in the future. Those who employ this method when investing ignore anything else happening in the financial world and focus purely on the charts.

Trading 212 does offer its own useful tools to try and minimise losses and reduce the risk involved. These include preventing accounts from going into a negative balance and also allowing their users to select a price point where investing is stopped and any profits are redeemed, or when certain losses are recorded. Even with these measures in place, CFDs are best left to those with a degree of expertise.

What is leverage?

When Trading 212 account users trade with CFDs, it is possible to use leverage. Leverage allows users to buy more units than their available funds, or initial deposit would allow them to. Leverage is displayed as a multiple and shows by how much you can multiply your available funds for a certain instrument.

An account has a default leverage level of up to 1:30. This can be increased up to 1:500 by upgrading your account to a professional account. To do this you have to meet at least 2 of the following criteria:

- Worked for at least 1 year in the financial sector

- Traded on average 10 times in each of the last 4 quarters on CFDs or Forex. This can be with either Trading 212 or another provider

- Hold an investment portfolio with a value of at least €500,000

Although leveraging may sound attractive, it carries its own risks too. As you are multiplying the amount of funds exposed, a small price fluctuation could have a significant impact. If the price of the CFD moves the wrong way, you could stand to lose the entire funds that you have deposited in your account.

Trading 212 are keen to grow their customer base. So keen in fact that if you sign up with them, they will credit you with a free share with a value of up to £100. It gets even better than this though, so let’s explain how it actually works.

Once you have created your account on the platform and made the initial minimum deposit (£1 or £10 if via bank transfer), you will be rewarded with your free share.

Once you are signed up, you can use your referral code up to 20 times meaning you have the chance to receive a further 20 shares for free. The shares are randomly issued so can be worth anything up to £100 each.

You can sell your shares instantly if you want to do this, but you can not withdraw the funds for 30 days after you received the bonus. This really is a zero-risk way to generate some money for yourself and build a portfolio.

The Trading 212 platform

Having already alluded to the Trading 212 mobile app, it is worth knowing that this isn’t the only option to trade the markets. As well as the mobile app, there is also a web platform that you can use to trade on.

Web Platform

There are alerts and notifications give which show how your portfolio is performing, but also shows major changes that have taken place across the markets on that day. You can easily access an overview of your portfolio and see how it is performing.

The mobile trading app

Much like the web trading platform, the mobile app is incredibly easy to use and navigate. Again there are alerts and notifications that are delivered throughout the day so that the user is always aware of any significant changes that have occurred.

Trading 212’s web trading platform is designed with ease of use in mind. The site is easy to navigate and is set out with a simple design, which allows you to easily see all of the information that is important to you.

The mobile app also allows access to Trading 212 forums and training videos.

Trading 212 fees

Usually, you would pay trading fees every time that you trade on the markets. Traditionally, these fees take the form of commission, spreads, financing rates, and conversion fees. There are also fees not directly related to trading such as withdrawal fees and inactivity fees.

Trading 212’s headline is that you can trade and pay zero commission. This is the case with 212 invest account, where there are no fees applied to stock and ETFs. With a Trading 212 account, there are also no fees for withdrawals or for inactivity.

Where fees are charged are when you are involved with CFDs or trading Forex. As well as ongoing fees, both of these attract a 0.5% currency conversion fee that you would have to pay if you were trading in a currency other than your own.

With CFDs and Forex being higher risk strategies, the fact that you can open an invest account as well as take advantage of the ISA option, and pay no fees, makes Trading 212 highly attractive.

How does Trading 212 make money?

With the draw of zero commission and a lack of other fees, you may be wondering how Trading 212 make money themselves.

Trading 212 makes its money from the CFD side of the business, with the revenue coming from spreads and interest swaps. Money is made by the spread between the highest and lowest prices. In general, investors will buy at the high price and sell low.

It is also possible that as time goes on, Trading 212 will introduce premium features that will require payment but, as yet, there is no sign of this happening.

How to open a Trading 212 account

If what you have seen so far makes Trading 212 sound appealing, then you are going to need to know how to create and open an account. Opening an account is easy and should take no more than 15 minutes to complete.

If you would like to try out the platform without registering, you can do this with a demo account and be ready to go in literally a matter of seconds. This is a risk-free way to explore the platform and trading tools that are available.

If you’re ready to open an actual trading account, Trading 212 will request documentation so that you can prove your address and your identity. Trading 212 will keep you updated via the app and email as to the stage of the verification process and if they need any further information. From experience, the verification process has taken just 1 business day.

Through the signup process, Trading 212 asks a series of questions to determine your level of trading experience. The risks of CFDs have already been covered, but it is at this point where, if you lack experience, an application to open a CFD account will be rejected.

An overview of deposit and withdrawal methods

There is a minimum deposit of £1 required to open your Trading 212 account. Whichever method you choose to make a deposit, is the same way that you will withdraw your funds. So for example, if you make your initial deposit via a debit card, any withdrawals will see your money being credited back to the same card.

Deposit and withdrawal methods that can be used on the platform are:

- Direct eBanking

- Giropay

- Bank transfer

- Credit card

- debit card

- Paypal

- Skrill

- Dotpay

With the Trading 212 platform, there are 9 different account base currencies available. Users can trade in 2 to 3 different account base currencies.

Trading 212 Customer Service

No review of a platform and its tools would be complete without considering the customer service that is offered.

Given that the nature of the platform, and the financial risk involved in some circumstances, it is important to know that help is on hand as and when you need it. With Trading 212, users can contact customer support via email, telephone, and the live chat function that they offer.

Having used the email option on 2 occasions (this was in relation to free shares being allocated), a response was received in less than 24 hours, and the issue was resolved beyond satisfaction: someone had not used my referral link correctly and so I had missed out on my free share. While it would have been easy for Trading 212 to just say that the steps hadn’t been followed so they couldn’t allocate a share, they simply allocated this anyway as a gesture of goodwill.

Trading 212’s customer support is available 24 hours a day, 7 days a week so there is reassurance that help is at hand whenever it may be needed.

Who is Trading 212 suitable for?

It was once the case that trading on the markets, and investing in shares was for the few. This free trading platform has changed this and, by using its trading platform at tools, opened trading up to the masses.

The availability of a free demo account makes Trading 212 suitable for beginners who want to dip their toe in the water and see what the world of trading is all about. This is a risk-free way to practise and learn, before investing your own money.

The Trading 212 forum also gives advice that is useful for novices and experts alike. Access to training videos allows users to further their learning and develop more confidence.

Although the Trading 212 platform can be great for beginners, it is important to stress again that this should be via the invest and ISA account options. CFDs are something for a novice to avoid because of the associated risks involved. CFDs, while they can be very profitable, are something to be left to the experienced traders who both understand the risk, and can afford the potential losses.

The main features of the Trading 212 platform

Having worked through what Trading 212 has to offer through this review, it may be worth a quick recap and summary to look at some of the key features that are on offer to its users:

- You can start trading with an investment of just £1

- Trading 212’s demo account allows you to practise with a virtual pot of £50,000

- Unlike other trading platforms, with Trading 212 you can invest with zero commission

- Fee-free ISA option that allows you to benefit from minimising your tax liabilities

- The ability to invest in some of the world’s biggest companies by using fractional shares

- Video guides and training to allow users to develop their understanding of trading

- Great customer support that is accessible 24/7

- There are no limits on the amount of free trades you can make and all trades are made instantly

Overall, the features offered by Trading 212 make the trading platform a very appealing one. With the opportunity to learn from a demo account, and to even start building your own portfolio through free shares, it is easy to see why newcomers to the world of trading markets are drawn towards 212 and take advantage of the zero-commission investment and ISA options.

It is not a platform purely for beginners though. Although CFDs carry significant risks, for those who are experienced in trading and who have an understanding of technical analysis, Trading 212 provides an attractive and easy to use platform for CFDs.

Not only does Trading 212 provide an easy-to-use trading platform it also offers security by being regulated by FCA and the fact that it is registered with the FSCS provides confidence for its users. If you are someone looking to get started in trading, or if you are someone seeking a new platform with an array of trading tools, then Trading 212 provides a safe environment, through both its website and mobile app, for trading on the markets.

FAQ

The minimum deposit is just £1 and that is all you need to get started

Simply sign up to Trading 212 and deposit £1. You will then be allocated your free share within 24hrs which you can then sell and withdraw back to your back account after 30 days

Trading 212 currently makes its money from the CFD side of the business, with the revenue coming from spreads and interest swaps.

Trading 212’s ISA is 100% fee-free. The lack of fees, and tax-free returns, effectively allows users free trading across all stocks and ETFs that are available in the Trading 212 Invest account.

This sounds really interesting, I am keen to look into doing some investing so this might be a good place for me to start. It looks very user friendly and great to be able to have a play around with a ‘pretend’ starting amount

This looks interesting. I used to work in an investment bank and always wondered if I could start trading myself

Considering I work in the industry I am surprised I have never heard of these guys. They sound like they offer a platform that gives you what you need. Although I am always worried that people that do not understand the markets put a lot of money in and do not understand the risk associated with buying direct equities.