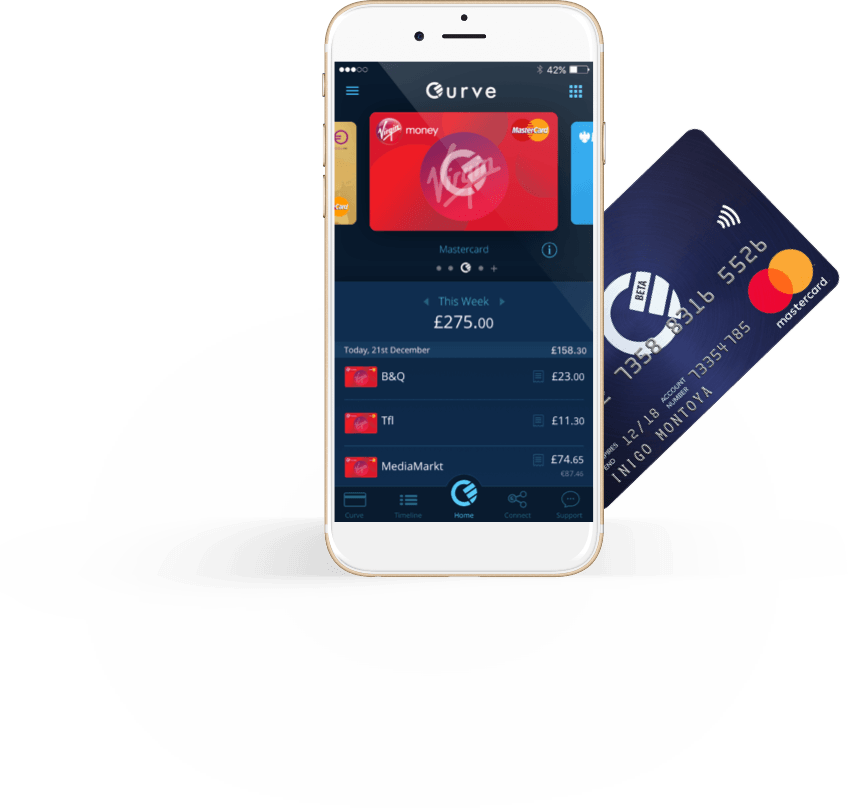

Curve Card is a new card from MasterCard which allows you to merge all of your cards in one place. In an age where most people have a couple of bank accounts, possibly a credit card or two and Android or Apple pay it can be hard to keep track of all of your money.

Curve Card aims to put a stop to financial headaches by merging all of your cards and accounts into one. You simply download the Curve app and then you can select which card is used during each transaction. You can add all of your MasterCard and Visa cards so then you can switch between them at will. It couldn’t be easier.

The Curve Card is a debit card – exactly the same as any other debit card you use or own. You can use it anywhere that debit cards are accepted – even places that don’t accept credit cards. It can be used online or in store – there really is no limit.

Benefits of having a Curve Card

There are many benefits to owning a Curve Card. These include

- It is completely free to get. Actually, it’s better than free. Curve will pay you £5 for getting a card.

- Whenever you make a debit card purchase using Curve and it charges it to your credit card you earn points on your credit card from a debit card transaction.

- You can withdraw £200 of cash a month from any ATM and charge it to your credit card as a purchase. This means that cash earns you points on your credit card.

- If you make any foreign currency transactions, they will be recharged to your card with a 1% exchange adjustment. This is better than using the card direct as this usually has a 3% foreign exchange fee.

- Curve comes in contactless form – so if your debit or credit card isn’t then you can still use these cards with contactless machines.

Reward scheme

As if all these benefits weren’t enough, for new customers Curve offers an excellent reward scheme. For the first three months that you own a Curve Card, they will offer you 1% cashback on any purchases made. This only applies to three retailers of your choosing – but choose the places you shop at often and you’ll soon see the rewards.

Retailers include –

- Tesco, Waitrose, Sainsburys, Just Eat, Deliveroo, BP, Shell, Netflix, Spotify and many others. Check out their website for a full list of selected retailers.

You can pay £50 for Curve Premium (although the extra benefits aren’t that great) and you will have access to cashback from six retailers instead of just three. You will also have access to a wider range such as Amazon, Uber, EasyJet and Ocado.

Curve Card limits

As with most forms of payment these days, there is a maximum limit on how much you can spend per day. As a new customer, the maximum is likely to be capped at £2000 per day but as the company learns your spending habits and trusts you more it will likely go up to £3750 per day. This is still an excellent amount.

It is so easy to order one – they’re completely free so there’s no harm in trying. Simply visit the Curve website, or download the app and order your free card. Once you have it you can link your existing MasterCard or Visa cards (credit or debit) and then start using the card! It’s free, easy and makes sense if you want to use your credit card in places where they only accept debit cards.

Collaborative Post

GIPHY App Key not set. Please check settings