If you’ve yet to hear of Curve, you may be missing out. In this review of the Curve Card, we’re going to take a look at all that you need to know about this Fintech company. We’re going to take a look at how the card works and examine the benefits that it has on offer.

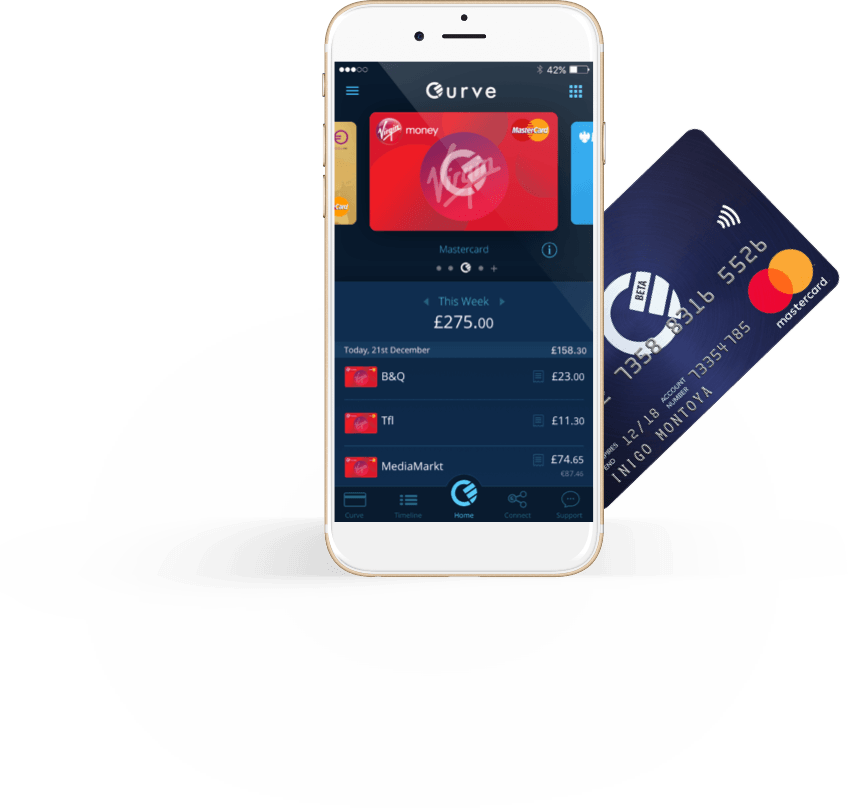

Curve itself is a Mastercard debit card, but it is a little different to the others that you probably have in your purse or wallet. In fact, what Curve aims to do is replace all of those other cards making life simpler and making transactions much easier.

How does Curve hope to achieve this you may wonder. What it does is link all of your existing bank cards in one place. Rather than leaving your house with numerous cards, all you need is Curve. You can then flick between the account that you want to pay with as they will all be linked to this smart card.

With the beta version launched back in 2016, Curve began to expand its offerings across Europe in 2018. Curve now claims to have amassed over 2 million users. We hope that this review will let you decide if you would like to join them.

The features of a Curve Card

So, if you weren’t already aware, you now know that Curve allows you to conveniently link your existing bank cards in a single place. That on its own is pretty good, but when you take a full look at what’s on offer, you’ll see that Curve offers so much more.

Let’s take a brief look at the Curve Card features:

- You can use your Curve Card worldwide

- Instant alerts are available for every transaction

- You can go back in time and switch which account you have paid with

- Your spending is colour coded so you can track where you are spending

- Cardholders can earn cashback when they spend (more on this soon)

- Go cordless by setting up Curve in your smartphone (Apple/Google Pay/Samsung Pay)

- Spend abroad without the fear of fees

- Avoid the embarrassment of declined cards

- Curve Customer Protection covers customers up to £100,000

As you can see, there is more to Curve than meets the eye. Before we get into exactly how it all works and the different accounts on offer, we want to delve into the detail of some of the key features above.

Cashback

One of the most exciting benefits that come with a Curve Card is the ability to earn cash back when you spend. Exactly how this works depends upon the Curve account that you sign up for and we’ll be looking at these soon. On a basic level, you are able to earn 1% cashback from up to six retailers.

You get to choose these retailers from an extensive list. The retailers are broken down into categories that include groceries, travel, food and drink, entertainment, shopping, and general. Some of the retailers you can expect to find include:

- Amazon

- NetFlix

- Boots

- BP

- Easyjet

- Marriot

- Aldi

- Tesco

- Waitrose

- Mcdonalds

- Nandos

This is just a handful of the retailers where you can benefit from cashback. Beyond the 1% that is on offer, Curve has one-off offers that crop up from time to time. Past examples have seen 20% cashback from the likes of Amazon Fresh, Five Guys, and Selfridges.

Go back in time

The go back in time feature is extremely handy if you’re like most of us and make the occasional slip-up. Given that you can link numerous cards to your Curve account, it is not impossible that you may select the wrong one for the funds to come from.

A mistake like this could see you plunging one account into your overdraft and you being eligible for fees. If this happens, Curve gives you the ability to go back in time and reverse the mistake that you made.

This feature means that you can go back up to 30 days. It covers you for purchases up to £5,000. It’s one of those things that you hope you’ll never need, but it’s great to know that it is there.

Anti-embarrassment mode

Have you ever been there fishing through your numerous cards? You know that you have the money to make a transaction, but you’re not 100% which account to use. You make the wrong decision and suddenly you’re seeing that your card has been declined.

When it comes to Curve, you only have the one card, but it is still possible that you select the wrong account to pay with. If that is the case, you can set up a backup payment method. If your payment is declined, Curve will automatically switch to your backup method.

This switch is seamless. The cashier has no idea that anything has happened. The result? Your blushes are spared and your transaction completes. Another feature that is more than a little handy.

How does Curve work?

Getting to grips with Curve Card is easy. Everything you need to know to operate your new account is found in the Curve app. This app can be downloaded from both iTunes and Google Play meaning that it works on both Apple and Android devices.

In fact, the Curve app is the place where you start your journey towards becoming a Curve account holder. By downloading the app, you’ll be asked the type of account that you want to go ahead with. You’ll then order your Curve card to be delivered to your home.

Once you have your account up and running in the app, it’s then time to link your cards. This is a very simple process. It can be done by scanning your bank cards, or if you prefer you can manually enter the details. You can add any Mastercard and Visa card.

Who your Curve card arrives, you can either use this to pay with or you can add it to Apple Pay, Google Pay, or Samsung Pay and go completely card-free. Once you start to spend, you’ll receive notifications meaning you can keep track of where you’re at.

Now that we’ve covered exactly how you can get and use your Curve card it may be a good time to tell you that you can get £5 for free, just for signing up.

How to get £5 for FREE with Curve

- Sign up and order a Curve card having used the exclusive offer link.

- Once you receive the Curve card to change the points from pending to available you need to either: Make a purchase (no minimum amount) or use the card at an ATM to change the pin or withdraw money.

Once you have signed up you will be given your own unique promo code. This is a great way to earn a little extra cash by doing very little work. Simply recommended Curve to your friends, family or wider community and for anyone that signs up using your code, you will both receive £5. It’s easy money.

The different Curve Card accounts

When it comes to signing up with Curve Card, you currently have three choices to make. You can choose between Curve Blue (the classic), Curve Black (premium), or Curve Metal (the ultimate). Each account has its own special features and starts from being free of charge up to being £14.99 a month.

Let’s have a look at each of the accounts so you can decide which one would work best for you:

Curve blue

This is the classic card that Curve has to offer. There are no monthly fees with this account, and here’s a look at what you get with this option:

- You can combine all your cards into one

- You can link to Google Play, Apple Pay, and Samsung Pay

- You can use either iOS or Android devices

- Curve Customer Protection up to £100,000

- The ability to go back in time up to 30 days up to a value of £5,000

- Access to fair FX rates up to a maximum of £500 per month

- Withdrawal from foreign ATMs free of charge – maximum of £200 per month

- Free 30 day trial of the cashback feature

Curve Black

If you are looking for access to the 1% cashback for the long-term, the Curve Black card allows this for £9.99 per month. You get access to all of the features included with the classic card, but you also get:

- 1% cashback from 3 selected retailers for an unlimited time

- Unlimited access to fair FX rates

- The ability to withdraw £400 a month from foreign ATMs free of any fees

- Worldwide travel insurance

Curve Metal

Curve Metal is the ultimate Curve account. With a £14.99 per month charge, you get all of the features included with Curve Blue and Curve Black, and you also get:

- Fee-free withdrawals from foreign ATMs up to £600 per month

- 1% cashback from 6 selected retailers for an unlimited time

- Mobile phone insurance

- Rental car collision waiver insurance

- Worldwide Airport LoungeKey access

Are there any spending limits with Curve?

There are spending limits attached to your Curve Card. These will differ depending upon the account that you hold. New customers may have lower limits initially while Curve is able to assess your spending habits. Here’s what you can expect from each account:

Curve Blue

- Withdraw a maximum of £200 cash each day

- Limited to a daily spend of £2,000

- A maximum spend of £5,000 on a 30-day rolling basis

- Limited to £10,000 a year on a 365-day rolling basis

Curve Black and Curve Metal

- Ability to withdraw £1,000 cash each day

- Daily spends up to £3,750

- Spend £20,000 per month on a 30-day rolling basis

- £50,000 limit each year on a rolling 365-day basis

There is also a Curve business card which may offer different spending limits. This is suitable for sole traders, partnerships, and directors of limited companies.

Is Curve Card safe to use?

The company behind Curve is regulated by the Financial Conduct Authority in the UK. This means that your details and data need to be managed and secured in line with FCA regulations. Beyond this, the Curve app will also allow you to lock your card in the event that it is lost or stolen.

Purchases with a Curve Card are not protected in the same way as credit card purchases. Credit cards have protection that comes from section 75 of the Consumer Credit Act. If you are making a particularly large purchase, and this is a concern then you may opt to pay with a credit card.

There may not be the protection that is offered by section 75, but Curve does have protections in place still. Its customers are covered by chargeback rights that are offered by Mastercard. This sees refunds being made if there are issues with goods being damaged, if they are not as described, or if the seller is no longer trading.

On top of this, Curve has gone one step further and introduced its own protection. Curve Customer Protection protects its customers’ money up to £100,000. Claims can be made for the following reasons:

- Good/services are not delivered

- The goods or services are faulty/fall below standard

- Items are counterfeit

- The seller has failed to honour a refund

- You have been charged more than once in error

Curve states that any issues need to be addressed to the merchant first. If you are unable to resolve the problem, you then have 120 days to raise it with Curve.

Is a Curve Card right for you?

We believe that a Curve account has some great benefits that are well worth taking advantage of. Some of the key pros of this card include:

- An easy to use app

- Keeping all of your cards linked in one place

- A basic card which is free of charge

- The ability to earn cash back when you spend

- Curve Customer Protection

The main draw of Curve is the ability to combine all of your cards in one place. That being the case, what if you don’t have multiple cards in the first place? Does just having a single card mean that Curve has nothing to offer you? We don’t think that is the case at all.

Even if you only hold one account, you still have the chance to earn cash back on your purchases. As well as this, you can still benefit from what’s on offer when it comes to making payments and withdrawing cash abroad.

Curve also allows you to see where you are spending with a quick cursory glance. The way your payments are displayed allows you to gain a very quick overview of where your spending is going each day. The fact that you can be notified each time there is a new transaction means that you are unlikely to be stung by any fraudulent transactions.

For us, Curve has much to offer and we believe that it deserves a place in wallets and purses everywhere. Why not take a look at the free Curve Blue where you can experience what Curve has to offer for free? Once you’ve seen how great Curve can be, you then have the option to upgrade to Curve Black or Curve Metal if you choose to.

Collaborative Post

I have a Curve card and absolutely love it. I love being able to take one card out and depend on the go back in time feature to stay organised with my finances between different accounts.

This sounds like a great idea. I like that there are different cards to suit different needs.

Never heard of a curve card, but this would deffo be of interest to us. I like how Cardholders can earn cashback when we spend x