Are you trying to save money, but keep dipping into the pot? For the majority, saving can be difficult. In order to start saving, you need to change the way you handle your money. Luckily, there are some apps that can help you save money and also develop healthy spending habits.

The 10 best money saving apps listed below all have different features, but can all help towards your goal. Whether it’s a new car, holiday or just a rainy day fund, the right app will help you save your money.

Plum

Plum works by linking to your bank account and analysing ways that you can save. It then deposits small amounts into a savings pot for you. You can still have control over the amount that gets saved by simply decreasing or increasing the amount you feel comfortable with saving.

There is another useful feature called round-ups. This takes the rest of your spend amount to the nearest pound and keeps the change in your new account. For example, if you spend £3.60, it will take the 40p and put it in your account to round it up to £4.

The app is user friendly and has a chat window that you can use to ask any questions, link your bank account and more, so everything is done in one place.

Price: The app is free, but you can potentially save more or even make more money by upgrading to the chargeable features – Plum Pro and Investing.

Money Dashboard

With Money Dashboard, you can link all of your bank accounts and cards so that you no longer have to log in to multiple apps.

Once you start spending, your spend from all will be automatically categorised into buckets such as eating out, household bills and so on. This alone will help give you insight as to where most of your money is spent and where savings can be made.

You can set budgets for how much you would like to spend in each category using the budget planner to help you identify areas to cut back on spending.

Price: Completely free.

Emma

Emma is fast becoming one of the most popular money saving apps offering a huge range of money management functionality.

Emma works by collecting information from all your available bank accounts, repayment accounts, and investments. Once you’ve given the app read-only access to your accounts (via Open Banking) it will then track all your incomings and outgoings in real time and provides you with a constantly up to date picture of your financial situation.

Emma offers everything from budgeting and financial reports through to live balances and even cash rewards you can claim within the app.

It really is a great app for people who are looking to take control of their finances. It doesn’t matter if you want to be kept in the loop with daily updates or are looking to make a more committed effort to budget more efficiently. There is even a Pro version of Emma which offers more functionality if you feel you are getting a lot of benefit out of the pap.

Price: Free, but upgrading to Emma Pro for £4.99 a month gives you added benefits such as Custom Categories, Exporting Your Data, Advanced Transactions Editing and the ability to Create and track offline accounts in any currency.

HyperJar

HyperJar lets you divide your money into virtual jars so that your budget and spending is categorised.

HyperJar is a Mastercard account that allows you to choose which jar you spend from so when you are in the supermarket, you spend from the Weekly Shopping Jar. The more you use the app, the more you will be able to analyse your spending habits and reorganise jars, increasing or decreasing budgets in order to reflect your goals.

So if you find you are spending more on eating out than expected, you can reassess and move money into the jar to continue to eat out as often, or keep to your budget and save more money.

Shared jars can be used for joint accounts, and can be set up instantly within the app. Up to 100 people can pay in to one jar, which is perfect for bill splitting amongst friends, family spending, or couples spending together.

Another great feature is that you can prepay accounts for popular partner retailers and brands, such as Lidl, Shell and Virgin Wines. When you do this, you will an Annual Growth Rate of 4.8% on every penny, so planning ahead can really help you save.

Your HyperJar card will work anywhere in the world with no extra fees or charges so it’s great for travelling abroad.

A child card will be coming soon and can be pre-ordered so that you are able to give pocket money and set up jars from your own app to help control your child’s spending while teaching them healthy spending habits.

Price: Free.

Snoop

Snoop is a free-to-use app that works to help you monitor your finances. Its main aim is to work around the clock in the background, making sure you’re always in complete control of your incomings and outgoings. Knowledge is power when it comes to this kind of stuff and Snoop provides you with all the information you need to make the right choices.

The app offers a large range of features which are perfect for anyone who wants to be in total control of their finances. Thanks to Open Banking you can easily connect all your bank accounts and credit cards into the app allowing you to view the balances and transactions of every account through the Snoop app at any time. Knowing how much money you have available to you and how much you owe is the first step to improving your financial situation. One of the biggest advantages this brings is that If you have a lot of different accounts then you no longer need to check in on each individual app and can instead do it all within Snoop

One of the best features of Snoop is the ability it has to monitor your transactions and see if you’re needlessly overspending in certain areas. If it thinks you are spending a lot on your bills then it will let you know that there are cheaper options available.

Price: Free to use.

Chip

With the Chip app, you can connect your bank account in seconds and start to save and track your money automatically. You can set goals and even earn money via Interest Accounts.

Chip calculates the amount you can save using AI, then automatically saves that amount for you. Every few days, Chip will automatically transfer small amounts of money from the bank account you have linked with it, into the app.

You can earn extra with Chip by getting your friends to sign up, with each friend adding 1% to your interest rate within your Chip account, up to a maximum of 5%.

Price: Free, but if you make more than £100 in autosaves in a 28 day period, you will be charged £1.

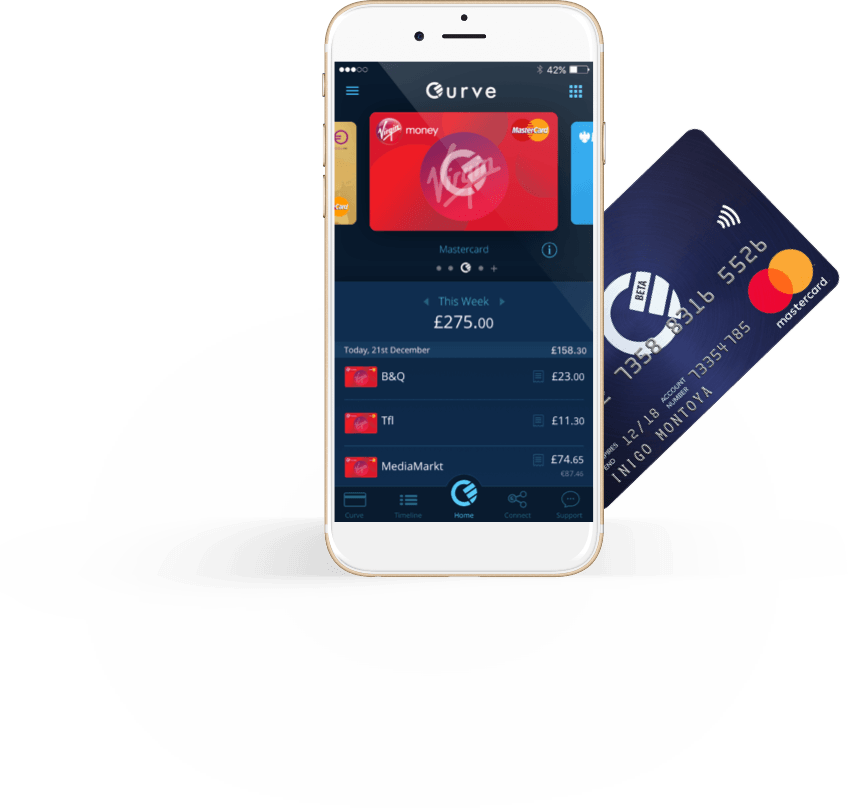

Curve

Curve aims to make money management easier by connecting all bank accounts into one single app and smart card. The main goal is to allow users to see the bigger picture when it comes to their finances and how they are spending.

As with many of the other money saving apps, transactions are automatically categorised so that you can see where you are spending most and where you might be able to cut back.

A really useful feature is that Curve lets you ‘go back in time’, meaning that if you unintentionally spend from the wrong account with your Curve card, you can quickly change this within the app.

You can also cashback earn rewards from selected retailers, including Tesco, Amazon, TfL and more.

Price: Standard Curve Mastercard is free and you are given £5 for FREE to spend anywhere online or offline. A premium account has a one-time fee of £50, but lets you earn double points for Curve Rewards.

Moneybox

Moneybox is a trading app aimed at beginners and young investors. Moneybox allows you to make your money work for you, helping you to begin investing in companies such as Disney and Netflix via simple tracker funds, even if you only have £1 in your account.

Moneybox also offers an opportunity to save your spare change using round-ups. You can round up your everyday purchases to the nearest pound to put the rest in a savings pot.

You can personalise the app to make saving easier for you, including adding a payday boost which saves more around payday, plus you can earn rewards via partner retailers such as ASOS, Hotels.com and more.

Not only can you save and earn money now, but you can also bring all of your pension pots together to plan better for the future.

Price: Start with £1 minimum contribution.

Squirrel

Squirrel is an app-based account that helps you stop overspending by splitting your salary into bills, goals, and weekly allowance. It keeps your bill money aside until it is due to be paid so you don’t need to worry about spending it by accident.

Choosing to have your payments weekly can help you manage your budget more easily than your usual monthly wage. Money is hidden until put into your spending account. You can also hide money that is set aside to achieve your saving goals and when you can’t see it, it’s harder to dip into it.

Price: £9.99 a month. Can be cancelled at any time.

Starling

Starling is another banking app with a dedicated card that offers spending insights to help you build budgets for different categories.

The goals feature allows you to create goals and send savings into the pot. You can set a target, and won’t be able to spend it unless you move it back into the main account. You can set up regular payments to the goal pot to ensure that you are consistently saving.

You can also set up automatic savings such as round-ups from your usual spending. A great feature with Starling is that you can increase your round ups, not only to the nearest pound, but you can multiply it by two, five or ten for extra automatic savings.

Price: Free.

FAQ

Most money saving apps work by taking advantage of the Open Banking protocol which allows you to access a variety of details from your bank account such as balances / transactions and the apps then use that information to help you get better at money management.

The majority of apps are free to use such as Chip, Curve, Snoop and Hyperjar. Some do require a monthly payment to access additional features.

Yes – They use Open Banking to access your bank account information and it is all regulated by the FCA.

The apps tend to make their money through either subscriptions for advanced features or promoting various deals to you within the app.

GIPHY App Key not set. Please check settings